This section examines the types of errors made that lead to E&O claims and the root problems that can cause them. Along with claims frequency data, this information offers direction on where to proactively focus your agency’s E&O risk management efforts.

On the average, about 1 in 7 policyholders will report a potential claim to their E&O carrier. Although, half of those claims may be closed with no payment or loss reserve, it is very likely that your agency at some point during its lifetime will be involved in a claims situation. E&O claims happen and while some of them may truly be mistakes, others could be where the customer simply has an uncovered loss and is looking for a deep pocket when the agency performed their legal duties.

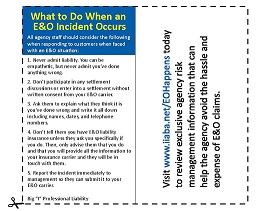

Click Image for Printable Wallet Card

Click Image for Printable Wallet Card

Do you know what to do if an E&O incident occurs? Print and keep this convenient wallet card that details what you should and shouldn't do if an E&O incident should occur.

All agency staff should always consider these details when responding to customers when faced with an E&O situation

Life of an E&O Claim